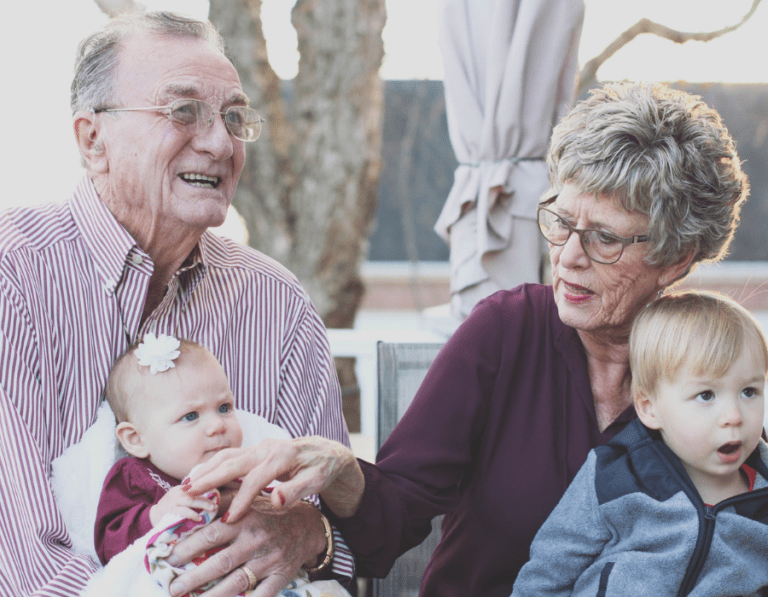

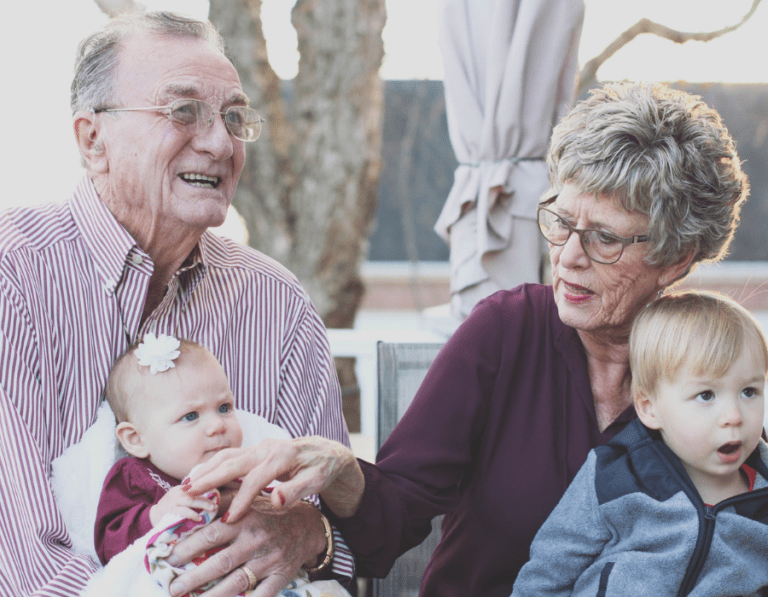

How to Talk with Children About a Grandparent with Dementia

Explaining dementia to children can be challenging. However, honest and compassionate conversations help them understand and cope with their grandparent’s condition.

Explaining dementia to children can be challenging. However, honest and compassionate conversations help them understand and cope with their grandparent’s condition.

Without proper planning, the high costs of nursing home care can quickly deplete your parents’ savings, leaving them financially vulnerable.

A trustee plays a critical role in managing a trust. However, if they become incapacitated, prompt action is necessary to protect the trust’s assets and beneficiaries.

Recognizing when assisted living is the best option can prevent safety risks, reduce stress for caregivers and improve a senior’s quality of life.

Managing and planning one’s estate sounds like a task reserved for the uber-rich. However, that’s a common, and potentially costly, misconception.

A special needs trust protects assets, while preserving eligibility for government benefits. However, spending must comply with legal guidelines to avoid jeopardizing support.

Proper legal representation is essential in guardianship. However, adults with disabilities often do not have the legal counsel to help advocate for the least restrictive options to protecting individuals’ rights and autonomy.

In an elder abuse horror story, a young woman spends $71,000 belonging to her uncle with dementia. Proper estate planning can safeguard your assets in the face of cognitive decline.

It’s common for parents of children with disabilities to worry about their childrens’ futures. However, one way they can provide support and give loved ones peace of mind is by creating a special needs trust.

To ensure that you don’t become a burden to your family as you approach the end of your life, planning is essential.

All fields marked with an “ * ” are required