Top Estate Planning Mistakes to Avoid

So, to leave a legacy for your family and those philanthropic groups you support, you need a comprehensive estate plan—and you need to avoid making mistakes.

So, to leave a legacy for your family and those philanthropic groups you support, you need a comprehensive estate plan—and you need to avoid making mistakes.

By considering these aspects of funeral planning now, you can provide a final gift to your loved ones—a well-thought-out plan that eases their load during a difficult time.

Your family may struggle to get the money you leave them if it gets caught in probate. Set up a trust to ensure that your loved ones are secure, even when you’re gone.

For people nearly or newly retired, who potentially still have decades ahead for their assets to compound and grow, estate taxes are a huge concern.

For couples with an age difference of 10 years or more, assets need to last significantly longer to cover both of their retirements, making the risks of missteps higher.

Thinking of buying a second home? Beware of real estate pitfalls when purchasing your vacation house.

Although many cases go unreported, the National Council on Aging suggests that the financial exploitation of the elderly may amount to a staggering $36.5 billion annually. That may just be the tip of the iceberg.

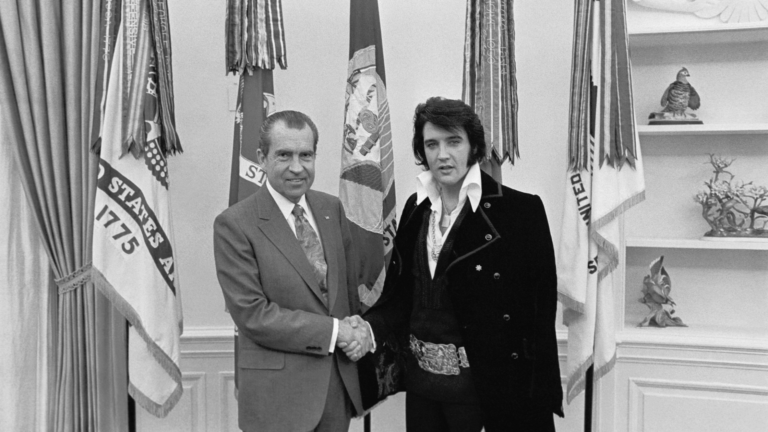

Learn from Elvis Presley’s estate planning mistakes and see how a comprehensive plan can help protect your family’s legacy and minimize future conflicts.

Inheriting a house? Learn the legal considerations and your options to ensure a smooth inheritance process.

Forgoing the legal entanglement of marriage can lead to troubling outcomes should one member of the couple face incapacity or an untimely death.

2500 S Power Road

Bldg 14 Suite 132

Mesa, AZ 85209

Copyright © LifePlan Legal AZ. All rights reserved. Some artwork provided under license agreement.

Privacy Policy | Disclaimer