Estate Planning Steps for Retirement

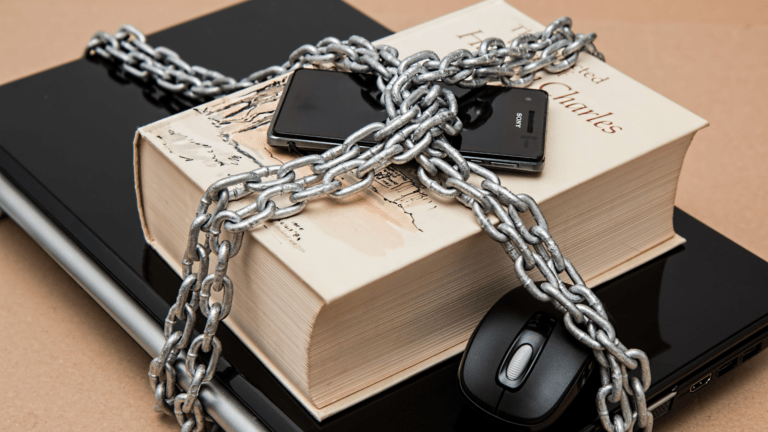

Retirement planning isn’t just about saving for the future—it’s about ensuring that your assets are protected and distributed according to your wishes.

Retirement planning isn’t just about saving for the future—it’s about ensuring that your assets are protected and distributed according to your wishes.

Every year offers a chance to step back, recalibrate and plan for the year ahead, and 2025 is no different.

You’ve worked hard for your wealth. Don’t let it fall into the wrong hands. Consider prenups, trusts and other protections to safeguard your family legacy.

Managing real estate in multiple states can complicate probate. However, with the right estate plan, you can help your family avoid the extra time, cost and stress.

Estate planning isn’t just about dividing assets—it’s about minimizing taxes and maximizing the inheritance that your loved ones receive.

HBO’s The Gilded Age dramatizes the privileged lives of some of America’s wealthiest families in late 19th century New York City.

Irrevocable trusts can be set up so that the trust maker no longer pays income taxes, and the taxes are instead paid by the trust.

For people nearly or newly retired, who potentially still have decades ahead for their assets to compound and grow, estate taxes are a huge concern.

Thinking of buying a second home? Beware of real estate pitfalls when purchasing your vacation house.

Understanding trusts and their tax nuances can empower you to make informed decisions regarding the type of trust you choose for your estate planning purposes.

All fields marked with an “ * ” are required