How Much Life Insurance Do Young Families Need?

For young families, life insurance provides financial security during the most vulnerable years—calculating the right coverage is essential for protecting those who depend on you most.

For young families, life insurance provides financial security during the most vulnerable years—calculating the right coverage is essential for protecting those who depend on you most.

Veterans earned their healthcare benefits through service and sacrifice—knowing how to access these benefits ensures timely care and long-term support.

We all know we’re going to die one day. There are things we should put in order before that time comes.

Pre-paid funeral plans can ease the burden on loved ones after death. However, understanding the risks and fine print is essential before making a commitment.

With more Americans pursuing early testing and care planning, Alzheimer’s disease is no longer viewed only as a crisis, but as a condition to prepare for thoughtfully and strategically.

Aging well requires a proactive approach to physical health, financial security and estate planning to ensure a stable and fulfilling future.

Bringing an aging parent into your home requires careful planning to balance their safety, comfort and your family’s needs.

Medicaid coverage does not automatically transfer between states—relocating requires careful planning to avoid lapses in healthcare benefits.

Developmental Disabilities Awareness Month (DDAM), observed annually in March, is the perfect time to highlight resources that can improve a child’s quality of life and long-term well-being.

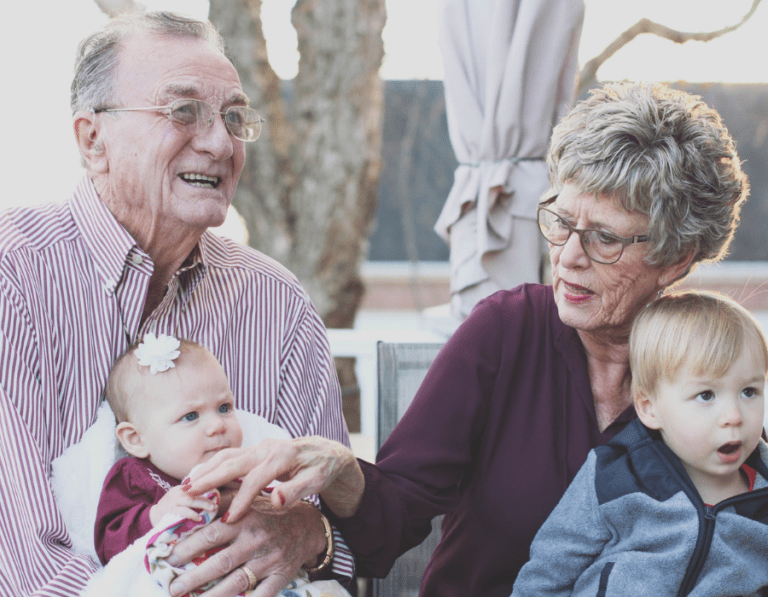

Explaining dementia to children can be challenging. However, honest and compassionate conversations help them understand and cope with their grandparent’s condition.