What Is a ‘Step-Up’ in Basis in Estate Planning?

The “step-up” in basis has to do with the calculation of the capital gains on the sale of property.

The “step-up” in basis has to do with the calculation of the capital gains on the sale of property.

When you think of a trust, you may have visions of contentious family gatherings in an attorney’s office after the death of a patriarch or matriarch. And sure, why not add sibling rivalries on par with the Roy family of Succession fame to keep things interesting?

There are some significant benefits of creating a living trust.

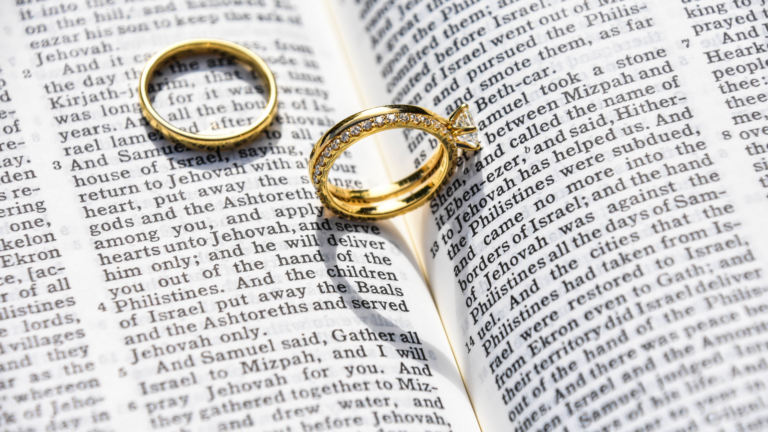

The family’s attorney and family office advisors should exercise caution in a marriage in which there are children from a prior marriage or other nonstandard family situations.

If you haven’t properly accounted for these things, your heirs may not be able to access these assets when you’re gone.

The heirs of an estate can be liable to pay the estate or income taxes (and perhaps other obligations) of the estate.

This sunsetting creates a big imperative for business owners to take a closer look at tax planning, and not treat a grim fiscal inevitability like another unfortunate surprise.

The modern blended family has far more needs when it comes to estate planning than a traditional family. Here are some challenges, tips and solutions.

The time to start researching elder care facilities, experts recommend, is before you need one. There are numerous options for elder care, and you don’t want to be caught flat-footed in the event of an unexpected health crisis. Those sudden situations can force you to make a quick decision without the knowledge to make an informed choice.

If you die intestate, this means that you died without a valid will in place.

2500 S Power Road

Bldg 14 Suite 132

Mesa, AZ 85209

Copyright © LifePlan Legal AZ. All rights reserved. Some artwork provided under license agreement.

Privacy Policy | Disclaimer