Well-Played: Country Legend Toby Keith’s Legacy Protected for His Family

Learn how country legend Toby Keith protected his family’s future through careful estate planning and why starting early is crucial for everyone.

Learn how country legend Toby Keith protected his family’s future through careful estate planning and why starting early is crucial for everyone.

Ensure that your children’s futures are secure by starting a comprehensive estate plan during back-to-school time. Schedule a consultation today.

Naming a beneficiary is a crucial step in estate planning. It promotes your wishes after you’re gone, streamlines inheritance, and spares your loved ones undue stress.

HBO’s The Gilded Age dramatizes the privileged lives of some of America’s wealthiest families in late 19th century New York City.

There are options for people who don’t have family—or don’t want their family—to handle their affairs.

By considering these aspects of funeral planning now, you can provide a final gift to your loved ones—a well-thought-out plan that eases their load during a difficult time.

Forgoing the legal entanglement of marriage can lead to troubling outcomes should one member of the couple face incapacity or an untimely death.

Explore key insights from Britney Spears’ conservatorship to enhance your estate planning. Ensure personal dignity and prevent financial abuse by setting clear guidelines and choosing trusted agents.

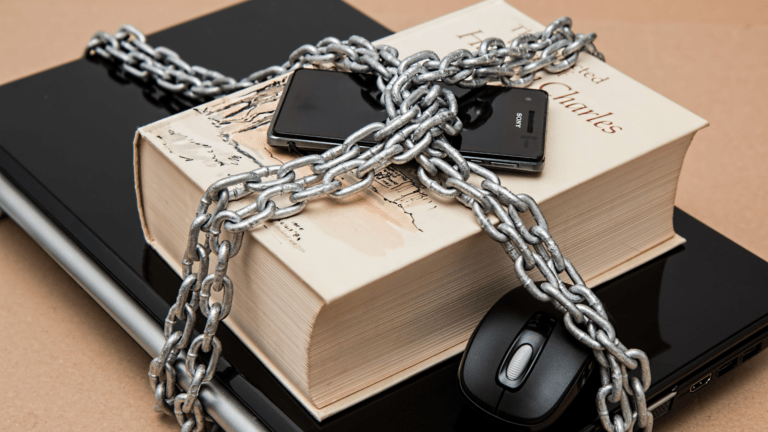

The terms ‘revocable trust’ and ‘living trust’ are commonly heard in an estate-planning context. You may hear people say, ‘My house is in trust for my children,’ or something along those lines.

Trusts are a smart and well-known estate planning tool that names or appoints a trustee to administer and distribute the assets according to the terms. However, how often do estate owners ask, “What if something goes wrong, and the trustee breaches their duties?”