How Much Life Insurance Do Young Families Need?

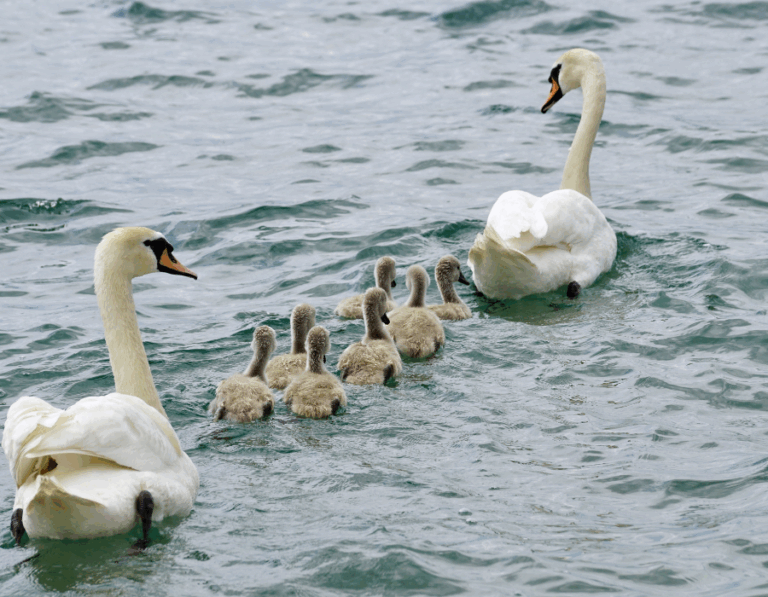

For young families, life insurance provides financial security during the most vulnerable years—calculating the right coverage is essential for protecting those who depend on you most.

For young families, life insurance provides financial security during the most vulnerable years—calculating the right coverage is essential for protecting those who depend on you most.

We all know we’re going to die one day. There are things we should put in order before that time comes.

If you die without a will, the state decides what happens to everything you leave behind: your money, your home and even your personal belongings.

There are many misunderstandings regarding estate planning that cause confusion.

Every year, we plan a wellness physical with our doctors because we understand that health is wealth that money can’t buy. However, do we take the same care and discipline with our financial health?

As the baby boomer generation ages, they will pass savings and assets on to their children, grandchildren and charitable organizations.

Reaching 100 isn’t just about good genes—traits like resilience, community connection and a sense of purpose are just as important to longevity.

If you’ve ever had to deal with outdated legal documents, you know it’s about as fun as trying to untangle last year’s Christmas lights.

No one expects a sudden medical crisis. However, being prepared can save your family from unnecessary legal battles and emotional distress.

With these pressures, personal estate planning often takes a backseat. This can lead to missed opportunities for minimizing tax exposure and cementing a founder’s legacy.